As we progress towards medium-term pandemic recovery, there is a renewed focus from central government and NHSE on delivering greater efficiencies, whilst continuing to improve quality of care and patient outcomes.

Unsurprisingly, Financial Improvement Plans remain a standing priority for NHS organisations, particularly in light of the recent NHSE announcement of up to 6% savings targets in FY23/24[1]. There is also additional pressure on ICBs to achieve financial balance, including those still carrying huge pre-pandemic deficits.

In light of this, the challenge is to address, achieve, and exceed previous performance, whilst sustainably offsetting inflation in the context of ever-increasing service demands, an over-burdened workforce, and ageing infrastructure.

Opportunities for Financial Improvement: ICBs and Collaboration

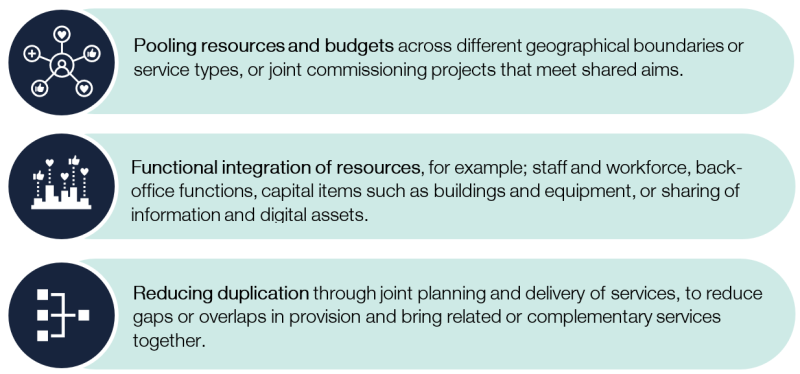

NHS leaders acknowledge that no single organisation can tackle the systemic and efficiency challenges facing the health and care sector alone[2]. Trusts and their system partners have been developing collaborative ways of working for several years as national policy has shifted away from competition to collaboration. However, workforce, funding, and investment barriers have been challenging to overcome. With the formalisation of ICBs, there is now a real opportunity to tackle the financial challenges with a collective effort, whilst acknowledging collaborative programmes can take longer to deliver to benefits and savings. Areas of focus for ICBs should include:

Akeso’s Approach:

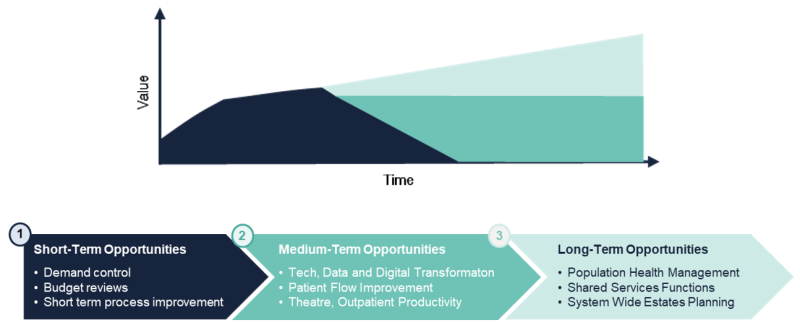

Our series on financial improvement plans for the NHS will look at pragmatic and tangible opportunities over differing time horizons and objectives, whilst also achieving clinical, operational, and patient benefits.

Quick-win, short-term initiatives can realise benefits within a year, and tactical savings within as little as 3 to 6 months. Medium-term schemes are designed to deliver between one to two years, and longer-term opportunities look two years and beyond, with some strategic programmes (e.g., system-wide estates planning) spanning over five years.

While cost reduction has become byword for relentless programmes of marginal gains, in the current environment organisations should a) take a holistic approach – managing cost pressures (including inflation) is arguably as important as identifying savings; and b) recognise that delivering better outcomes with the same resource has significant value.

The next article in our Financial Improvement series will provide further detail on the proven methodologies to deliver savings in the short- and medium-term. We will then set out how Population Health Management can support ICBs in the long-term.

For more details, please get in touch with Scott Healy, who leads our Financial Improvement offering.

For more details, please get in touch with Scott Healy, who leads our Financial Improvement offering.

References

[1] HSJ. ICSs get significantly harder savings target of 6pc. 2023. [online] Available at: https://www.hsj.co.uk/finance-and-efficiency/icss-get-significantly-harder-savings-target-of-6pc/7034819.article

[2] NHS Providers. 2022. [online] Available at: Making the most of the money: Efficiency and the long-term plan (nhsproviders.org)